Shenron1226

Avid market observer and seasoned trader, driven by a relentless pursuit of profitable opportunities. I thrive on the intellectual challenge of deciphering market movements and developing innovative trading strategies.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

BREAKING 🚨 THE BANK OF ENGLAND JUST CUT INTEREST RATES TO 4%

JEROME POWELL IS NEXT

JEROME POWELL IS NEXT

- Reward

- like

- Comment

- Share

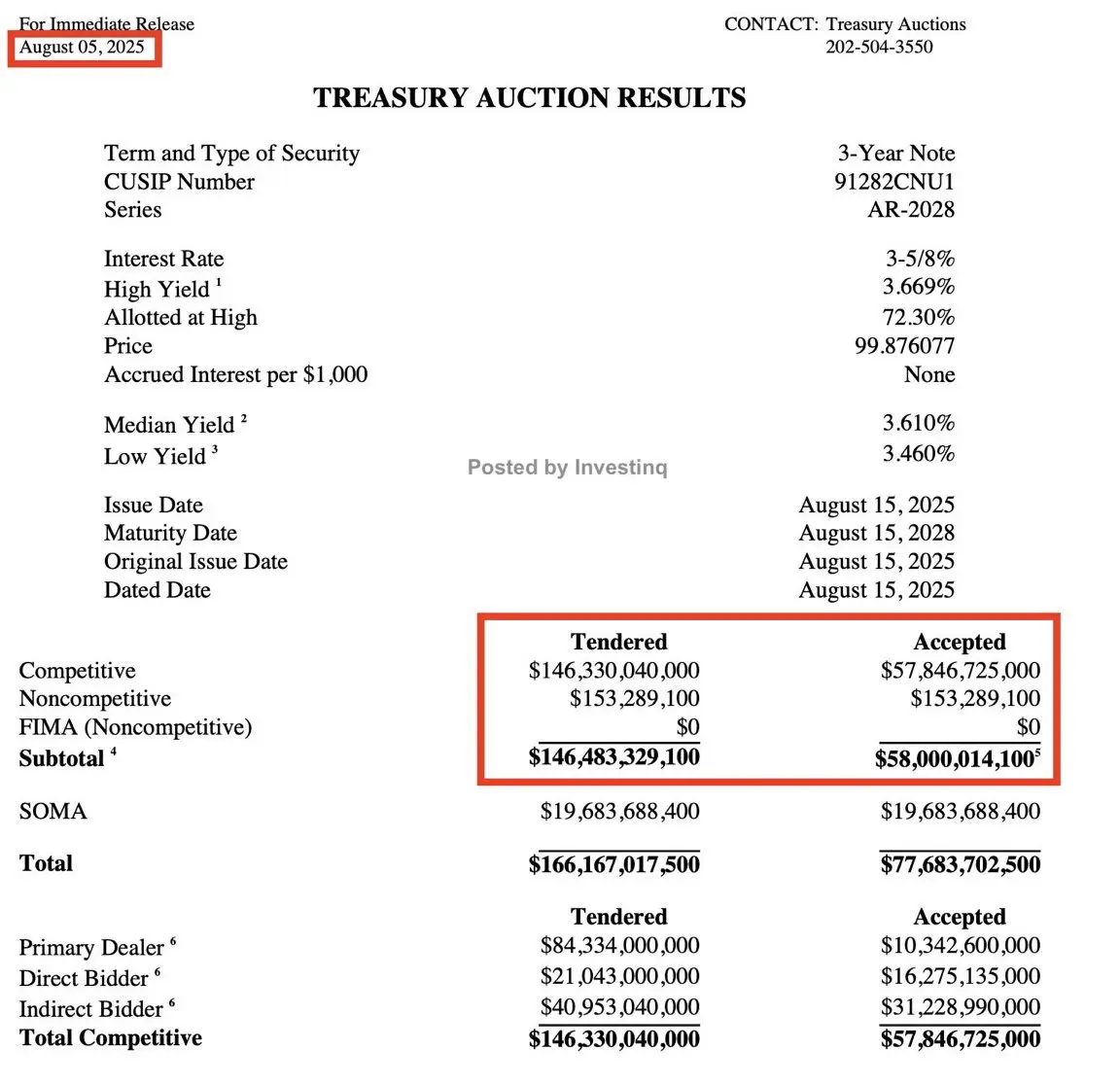

BREAKING:

🚨 U.S. TRIED RAISING $58B IN DEBT BUT DEMAND HIT A 1-YEAR LOW.

IF THIS CONTINUES, THE FED BE FORCED TO PRINT.

BITCOIN & RISK ASSETS WILL SOAR

#Fed Officials Signal Rate Cut#

🚨 U.S. TRIED RAISING $58B IN DEBT BUT DEMAND HIT A 1-YEAR LOW.

IF THIS CONTINUES, THE FED BE FORCED TO PRINT.

BITCOIN & RISK ASSETS WILL SOAR

#Fed Officials Signal Rate Cut#

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

🇺🇸🇹🇼 TRUMP ANNOUNCES A 100% TARIFF ON ALL SEMICONDUCTORS ENTERING THE USA.

60% OF THE WORLD'S SEMICONDUCTORS COME FROM TAIWAN.

60% OF THE WORLD'S SEMICONDUCTORS COME FROM TAIWAN.

TRUMP3.45%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- 1

- Comment

- Share

🇨🇳 IN: China is in FOMO mode as it rushes to launch yuan-backed stablecoins, driven by fears of capital flight and growing pressure from U.S. dollar-pegged tokens.

Here’s why it matters:

🏢 JD and Ant Group are lobbying Beijing to approve offshore yuan tokens for trade and payments as a direct counter to dollar stablecoins.

⚖️ Regulators warn stablecoins could trigger outflows and weaken China’s capital controls.

🔐 Hong Kong will issue a limited number of licenses for B2B use, backed by full reserves and strict compliance.

Here’s why it matters:

🏢 JD and Ant Group are lobbying Beijing to approve offshore yuan tokens for trade and payments as a direct counter to dollar stablecoins.

⚖️ Regulators warn stablecoins could trigger outflows and weaken China’s capital controls.

🔐 Hong Kong will issue a limited number of licenses for B2B use, backed by full reserves and strict compliance.

- Reward

- like

- Comment

- Share

UPDATE: DeFi reacts bullishly as the SEC confirms liquid staking protocols aren’t securities.

$LDO (Lido) and other staking tokens jumped, while total LST TVL holds steady at $67B.

Regulatory clarity just gave staking a major tailwind. #SEC on Liquid Staking#

$LDO (Lido) and other staking tokens jumped, while total LST TVL holds steady at $67B.

Regulatory clarity just gave staking a major tailwind. #SEC on Liquid Staking#

- Reward

- like

- Comment

- Share

- Reward

- like

- 2

- Share

GateUser-a86bc530 :

:

goodgoodgoodgoodgoodgoodView More

📈 LATEST: Ethereum treasury stocks are outperforming ETH ETFs.

🔹 Since June, both ETH ETFs and treasury firms have snapped up about 1.6% of ETH supply, signaling rising institutional demand.

🔹 Treasury companies like BitMine and SharpLink offer access to staking rewards, ETH-per-share accumulation, and regulatory arbitrage, making them more compelling than passive ETFs.

🔹 With NAV multiples normalizing above 1, Standard Chartered says these firms may be better buys than spot ETH ETFs.

🔹 Since June, both ETH ETFs and treasury firms have snapped up about 1.6% of ETH supply, signaling rising institutional demand.

🔹 Treasury companies like BitMine and SharpLink offer access to staking rewards, ETH-per-share accumulation, and regulatory arbitrage, making them more compelling than passive ETFs.

🔹 With NAV multiples normalizing above 1, Standard Chartered says these firms may be better buys than spot ETH ETFs.

- Reward

- like

- 2

- Share

GateUser-a86bc530 :

:

HODL Tight 💪View More

- Reward

- like

- 1

- Share

GateUser-a86bc530 :

:

goodgoodgoodgoodgoodgood- Reward

- 1

- 2

- Share

Romario81 :

:

what does this meanView More

🇦🇪JUST IN: Dubai approves first crypto options license.

Dubai’s tax-free, pro-crypto stance could challenge Western crypto dominance amid tighter 🇺🇸U.S. and 🇪🇺EU rules.

Dubai’s tax-free, pro-crypto stance could challenge Western crypto dominance amid tighter 🇺🇸U.S. and 🇪🇺EU rules.

IN0.94%

- Reward

- 2

- Comment

- Share

INSIGHT: Ethereum treasury companies will compete for yield in DeFi to be able to raise ever more funds from TradFi investors.

The race has already begun.

#ETH ETF Sees 12 Weeks of Inflows#

The race has already begun.

#ETH ETF Sees 12 Weeks of Inflows#

- Reward

- 1

- Comment

- Share